Say Hello To Remote Bookkeeping.

The accounting experts at Openstartup will accurately maintain your books while you focus on growing your business.

Less Stress. More Peace Of Mind.

Online bookkeeping service powered by experienced accountants.

Openstartup Remote Bookkeeping is the most trusted online bookkeeping service designed for business owners who want to outsource the accounting process.

It gives you the freedom to focus on your business, knowing you’ll have accurate and reconciled books every month.

Get the benefits of a professional bookkeeper at a price you can afford, and powerful financial reporting software with zero learning curve.

How Remote Bookkeeping Works

Get Your Account Setup

We're excited to pair you with a dedicated bookkeeper who will grasp the intricacies of your business. They'll expertly configure your accounting system.

Send Your Transactions

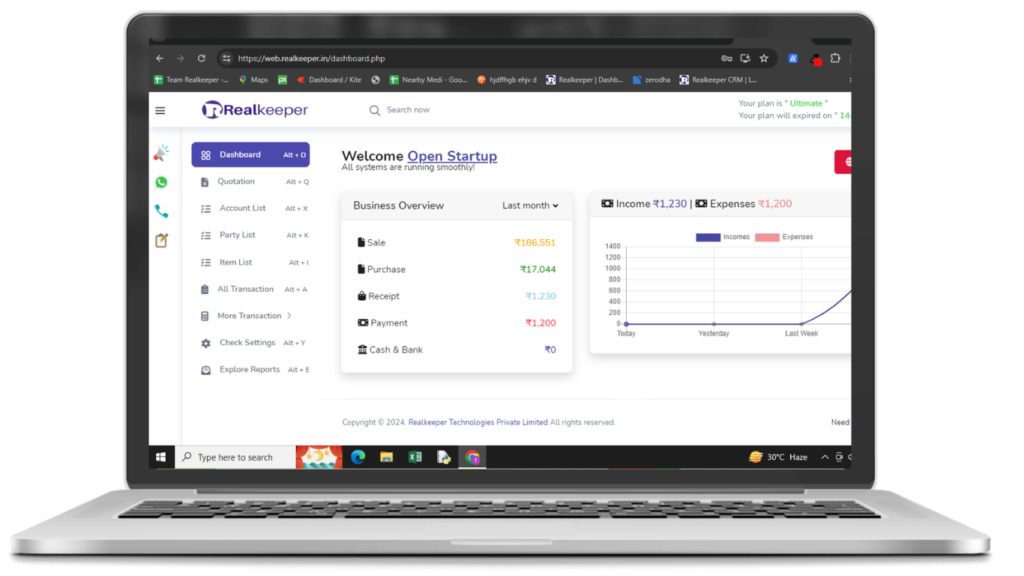

You have two secure options to send transactions: utilize the OpenStartup application or send them via personal email.

Monthly Report Delivery

Your books are reconciled & you receive a detailed monthly report containing your profit and loss, balance sheet, and cash flow statement.

How You Can Benefit From Remote Bookkeeping

Openstatrtup experts will take care of accounting while you focus on growing your business.

What you'll get after signup :

- Personal onboarding and business setup

- A dedicated Bookkeeper for recording transactions.

- Monthly categorization of your income & expenses.

- Reconciliation of your bank statement.

- Business reports to see how youre doing month to month.

- Free access to premium accounting software – Openstartup.in

What Our Clients Say

Frequently Asked Questions

Online bookkeeping involves managing financial records electronically using specialized software accessible via the internet. It includes tasks such as recording transactions, categorizing expenses, generating invoices, reconciling bank statements, and producing financial reports. This method offers convenience, real-time updates, and streamlined collaboration between accountants and clients, making it efficient for businesses to track their finances remotely.

Online bookkeeping services typically do not involve in-person consultations or physical document handling. They also may not include extensive financial analysis or strategic advisory services beyond basic reporting. Complex tax planning or legal advice may require additional expertise beyond the scope of standard online bookkeeping. Additionally, while online bookkeeping provides software for managing finances, it may not handle physical inventory management or specialized industry-specific accounting needs.

As an AI language model, I don’t provide services directly, including tax preparation. However, many online bookkeeping services offer tax preparation as an additional service or integrate with tax preparation software to streamline the process. These services may include organizing financial data, generating tax forms, and providing support for tax-related questions, but it’s essential to check with specific service providers for their offerings and capabilities regarding tax preparation.

OpenStartup is a concept and framework for transparently sharing business metrics and insights among startups. It doesn’t replace traditional bookkeepers or accountants but rather complements their work by providing a framework for sharing certain types of data and insights. Your bookkeeper or accountant plays a crucial role in managing your financial records, providing advice, and ensuring compliance with tax regulations, which OpenStartup does not directly address.

Outsourcing business accounting offers numerous benefits. It allows you to focus on core operations, saves time and money on hiring and training in-house staff, provides access to expert accounting professionals, ensures compliance with regulations, offers scalability to match business needs, and reduces the risk of errors. Additionally, outsourcing can provide valuable insights and support for strategic financial decision-making.

Yes, having someone to talk to can offer various benefits. It provides emotional support, a listening ear, and the opportunity to share ideas and concerns. Conversations with others can also foster understanding, strengthen relationships, and lead to new insights or solutions to challenges. Whether it’s a friend, family member, colleague, or professional, talking with someone can be valuable for personal and professional growth.

You can view your financial information through various channels, including online banking platforms, financial management apps, and accounting software. These tools offer access to account balances, transaction histories, expense tracking, budgeting features, and financial reports. Additionally, you may receive statements via email or traditional mail from banks, credit card companies, and investment firms, providing detailed overviews of your financial activities.

The decision for an accountant to visit your office in person depends on various factors, including the accountant’s preferences, the nature of the work, and your specific needs. While some accountants may offer in-person consultations or on-site visits for certain tasks, many now conduct business remotely, leveraging technology for communication and collaboration. It’s advisable to discuss your preferences and requirements with your accountant to determine the best approach for your situation.